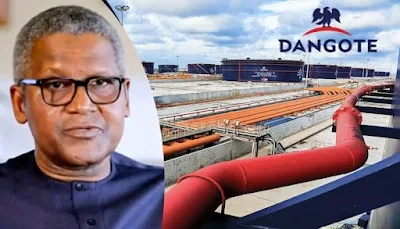

Aliko Dangote, the President of the Dangote Group, has called on the Nigerian federal government to terminate all crude oil-for-loan agreements.

He made this statement on Wednesday at the Crude Oil Refinery-owners Association of Nigeria Summit in Lagos. These deals typically involve the exchange of crude oil for financial loans or infrastructural projects, often with foreign entities, as a way to fund domestic projects or meet financial obligations.

Dangote’s position is likely motivated by concerns that these deals might not be in Nigeria’s long-term interest, as they could result in unfavorable terms or undermine the country’s control over its natural resources.

He may also believe that Nigeria should focus on refining its own crude oil domestically, reducing its dependency on external parties, and building a stronger, self-reliant energy sector.

By ending these agreements, Dangote likely envisions a scenario where Nigeria can better leverage its oil wealth to fuel domestic economic growth, especially with major refineries like the Dangote Refinery soon coming online. This move could help Nigeria retain more value from its crude oil production and invest in long-term infrastructural development without external financial obligations.

The Nigerian billionaire and Africa’s richest man, Aliko Dangote, who was represented by the Executive Director of Dangote Group, Engr. Mansur Ahmed, emphasized the need for Nigeria to avoid mortgaging its future wealth through crude-for-loan deals.

To ensure sufficient feedstock availability, we must stop mortgaging our crude. It is unfortunate that, while countries like Norway are securing their future by investing oil proceeds into national wealth funds, in Africa, we are spending oil proceeds from the future today,” he said.

In June 2024, the African Export-Import Bank (Afreximbank) disbursed $3.175 billion to the Nigerian government as part of a $3.3 billion crude-for-loan syndicated facility through the Nigerian National Petroleum Company Limited (NNPC).